39+ mortgage interest deduction california

Web California currently allows the deduction to apply to interest on debt of up to 1 million owed for a taxpayers first and second homes. Web The mortgage interest deduction is a tax incentive for homeowners.

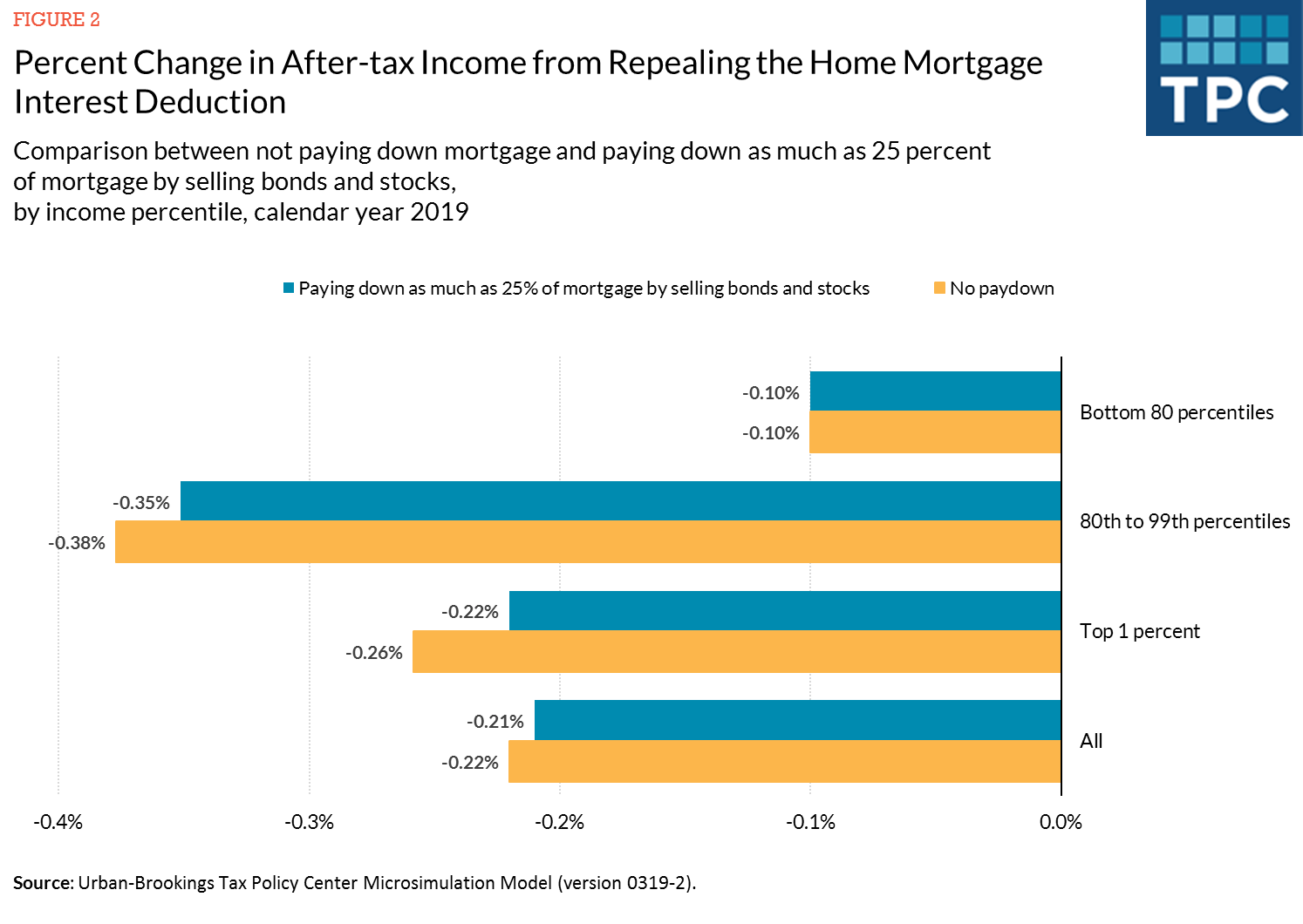

How Would Paydown Affect The Reform Of Home Mortgage Interest Deduction Tax Policy Center

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

The bill would have also. Discover Helpful Information And Resources On Taxes From AARP. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

This itemized deduction allows homeowners to subtract mortgage interest from their. Federal changes limited the mortgage interest deduction debt maximum from 1000000 500000 for married. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Even the Trump administration thought that the MID cap was excessive and capped the federal deduction at 750000 per home. Web If youve closed on a mortgage on or after Jan. Web The mortgage interest deduction applies to different types of mortgage interest including interest charged monthly as part of your regular mortgage payment and points paid.

Homeowners who bought houses before. Web Most homeowners can deduct all of their mortgage interest. Ad Download Or Email Pub 936 More Fillable Forms Register and Subscribe Now.

Web For Mortgage Interest and Property Tax you should not enter either one of those figures into the Deduction and Credits section of TurboTax. Web According to this State of California website this deduction will allow deductions for home mortgage interest on mortgages up to 1 million plus up to. However higher limitations 1 million 500000 if married.

California has around 40 million. Web California does not permit a deduction for foreign income taxes. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Changes To California Mortgage Interest Deduction Limit In 2018

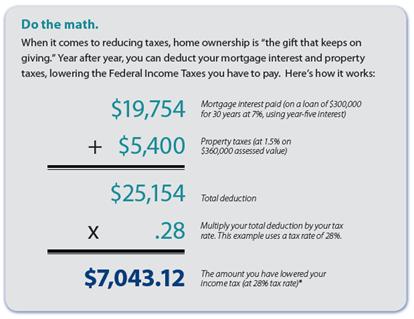

Coming Home To Tax Benefits Windermere Real Estate

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

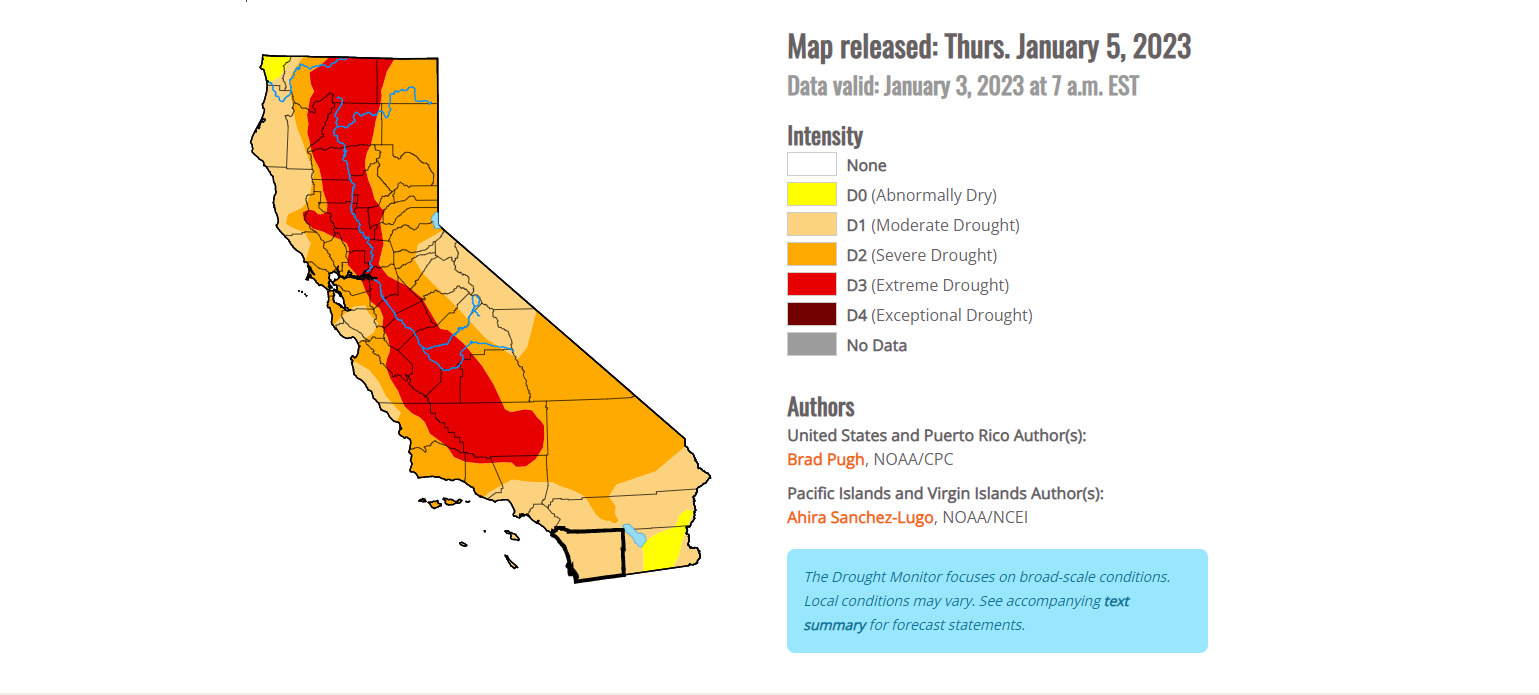

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Bay Area Home Buyers Face Mortgage Deduction Slam From Gop Tax Cut Plan

If Gop Scales Back The Mortgage Interest Deduction Californians Would Be Hit Hardest Los Angeles Times

3 Common Tax Deductions For California Homeowners Robert Hall

Bay Area Home Buyers Face Mortgage Deduction Slam From Gop Tax Cut Plan

California Bill Targets Tax Breaks For Wealthy Homeowners Nbc Bay Area

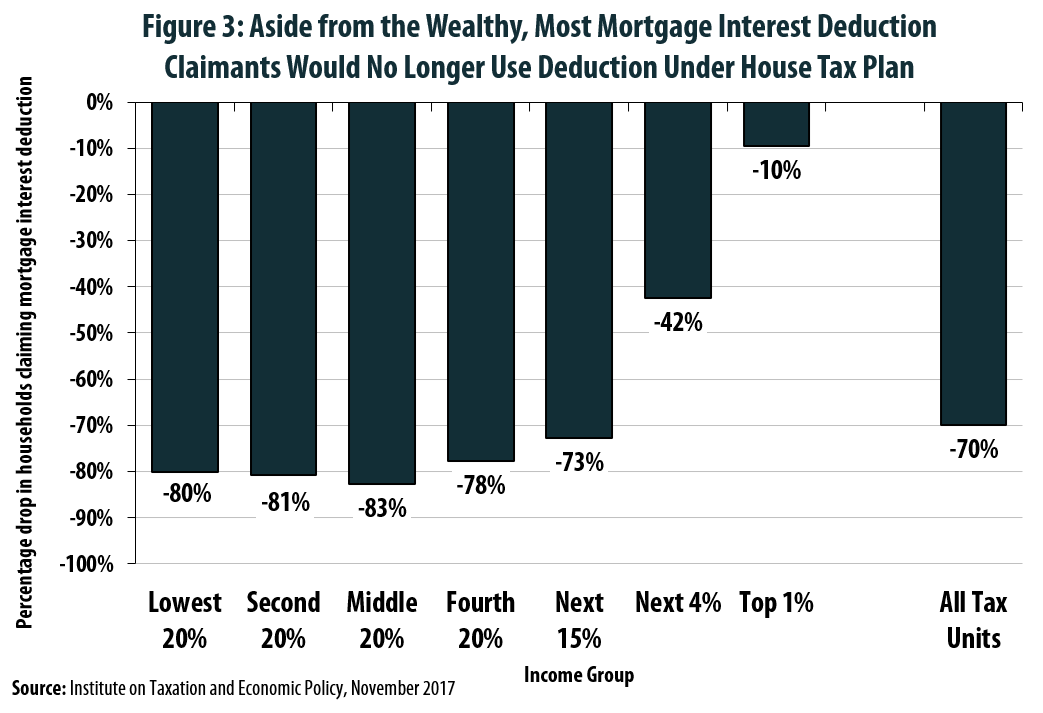

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

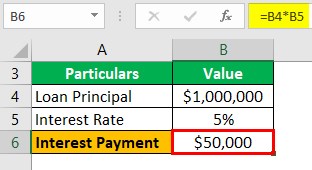

Mortgage Interest Deduction How It Calculate Tax Savings

The Mortgage Interest Deduction Tax Subsidy For The Rich Must Go The Sacramento Observer

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Bay Area Home Buyers Face Mortgage Deduction Slam From Gop Tax Cut Plan

Is My Mortgage Interest Still Tax Deductible The Henry Levy Group A Cpa Firm