30+ Front end debt to income ratio

Ad Compare Top 7 Working Capital Lenders of 2022. Housing expense consists of no debts other.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

The front-end ratio would be 030 slightly higher than an acceptable front-end ratio.

. For example if you pay 700 on credit cards 300 on car loans and 2000 a month in rent your total monthly debt commitment is 3000. The ideal front-end DTI should not be more than 28. On the off chance that a homeowner has a mortgage the front-end DTI is ordinarily calculated as housing expenses like mortgage payments mortgage insurance and so on partitioned by gross.

I have no other debt but my front end DTI ratio would be at 35 with the two mortgages back end DTI also 35. Back End Debt To Income Ratio. If you make 60000 a year your monthly gross income is 60000 divided by 12 months for a total of 5000 a month.

Find Step-by-Step Assistance to Pay Your Debts. As a general rule of thumb you want to have a DTI ratio between 35 and 50. Ad Take Some of the Stress Out and Get Help Managing Debt.

The front-end debt-to-income DTI ratio is a variety of the DTI that computes the amount of an individuals gross income is going toward housing costs. The back-end ratio considers all the minimum monthly payments you make towards all. Your debt-to-income ratio or DTI is your total monthly debt payments divided by your total monthly gross income.

DTI ratio is one of the criteria lenders use to determine whether you can realistically pay back a loan. Save more spend smarter and make your money go. Your debt-to-income ratio is 3000 divided by 5000 which works out to 06 or 60.

One of the easiest and quickest High Debt To Income Ratio Mortgage Solutions is by choosing a 71 ARM instead of a 30-year fixed-rate mortgage. For government-back loans such as FHA loans the. Ad Compare 2022s Best Personal Loan Interest Rates to Enjoy the Best Perks in the Market.

By using this method you can calculate your debt-to-income ratio for your back-end ratio. Verify your mortgage eligibility Sep 6th 2022 Front-end debt-to-income ratio. Borrowers who choose a 51 ARM may have rates lowered by 0125 than a 71 ARM However.

Your lender can then add the front-end ratio after assessing your projected expenses with your mortgage. The front-end debt-to-income ratio is calculated as a percentage by dividing the housing expense by the gross income. Apply Now Get Low Rates.

It is calculated by adding up your total monthly bills such as your credit card debt payments personal loans car loans and housing expenses. You divide 2375 by 10500 which sets out to be 0226. In reality the back-end debt-to-income ratio may be a more critical factor in a lenders decision on whether to offer financing.

So on the front end debt to income ratio the mortgage loan applicant qualifies. If your current front-end DTI is in the 40 or higher range you are likely headed for some significant financial difficulties and should immediately consider a plan to reduce your debt balances. Trying to get approved for a 150000 house with 30K down problem is I already have an existing 670 mortage payment on another house.

This calculator uses the following formulas to calculate debt-to-income ratios. Front End Debt To Income Ratio On How Much I Can Borrower. The back-end DTI ratio shows the income percentage covering all your monthly debts.

Lenders always prefer borrowers with a lower debt-to-income ratio. If your gross income the amount you earn before taxes is 6500 per month your front-end DTI ratio is 29. Front-End Ratio Monthly Housing Debt Gross Monthly Income Back-End Ratio All Monthly Debt Gross Monthly Income Check out our Online Debt Snowball Calculator which helps you understand how to accelerate your debt payoff Currently 4075 1 2 3 4 5 41.

Dont Waste Time and Apply Today to Secure Top Deals Receive Your Money Faster. Conventional loan debt ratios are 28 front-end and 36 back-end based upon. Today the debt ratio requirements for an FHA loan are 29 front-end ratio and 41 back-end ratio based upon gross income.

The front-end debt-to-income ratio or the housing ratio compares a persons gross income to the amount spent on housing costs. For conventional loans the standard maximum back-end DTI is 36. Posted by E46M54 Front end debt to income ratio problems.

This debt-to-income ratio calculator is designed to help you understand what you need to do in order to qualify and close on a mortgage loan. You turn the fractional part into a percentage which results in 226. Lenders consider two types of debt-to-income ratios during the mortgage process.

The front-end DTI includes the expenses related to housing. The back-end DTI starts with the same expenses and debt included in the front-end DTI and adds all other debts. Instead assume that the income is 12000 monthly resulting in a front-end ratio of 025 which is within the accepted limits.

The first is the front end debt to income ratio and the second is the back end debt to income ratio. A 160000 monthly principal and interest mortgage payment at a 425 30 year fixed rate term is equivalent to a 325000 loan amount.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Ex 99 2

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Cmbs Disputes On The Horizon April 2021 Quinn Emanuel Urquhart Sullivan Llp Jdsupra

How To Improve Your Credit Age Of Credit History Credit Com

If Someone Took The Us Debt To Income Ratio And Made A Percentage Comparison To A Household Budget Of 80 000 What Would The Numbers Be Quora

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street

What Bills Are Calculated In The Debt To Income Ratio Quora

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

How Much Do I Need To Retire As A Physician Wealthkeel

![]()

What Is Your Current Debt To Income Ratio R Realestate

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

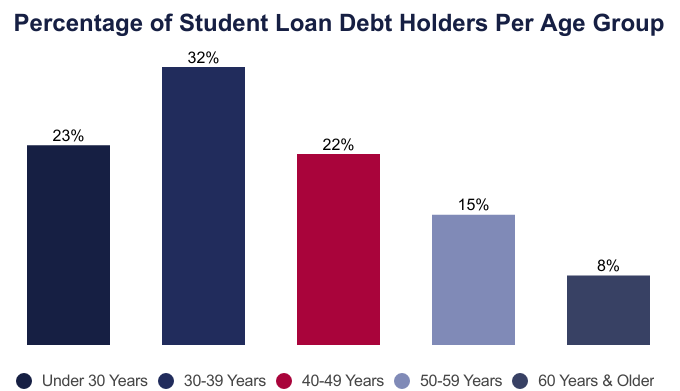

Average Student Loan Debt By Age 2022 Facts Statistics

2

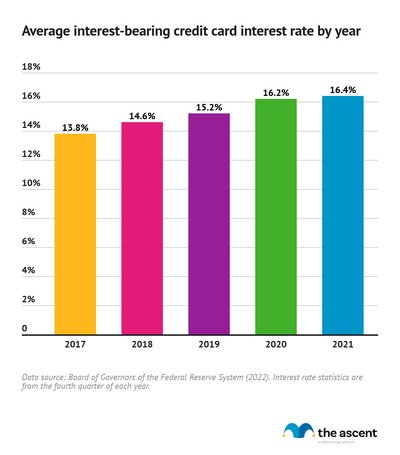

Credit Card Debt Statistics For 2022 The Ascent

19 Amazing Money Saving Challenges For You To Save More In 2019 The Best Of The Land Of Milk And Money Money Saving Challenge Savings Challenge Saving Mo

Bank Debt Vs Corporate Bonds Comparison Of Features And Pros Cons